Why Car Payments Are Skyrocketing and How It Impacts Your Finances

Explore why car payments are soaring, how high interest rates and long loan terms affect your finances, and practical tips to manage vehicle costs wisely.

💡 Learn more: Check out our guide on The Debt Trap Most Beginners Fall Into for deeper insights.

Why Car Payments Are Skyrocketing and How It Impacts Your Finances

Car payments have reached unprecedented levels, leaving many consumers wondering how people are managing to afford them. With the average new car payment nearing $745 per month and used car payments averaging around $521, the financial strain is real and widespread. High interest rates—around 7% for new vehicles and climbing to 12% for used—only add to the challenge. This article explores the reasons behind these soaring payments, the consequences for household budgets, and strategies to avoid falling into financial traps.

💡 Learn more: Check out our guide on The Debt Trap Most Beginners Fall Into for deeper insights.

Table of Contents

🚗 The Rising Cost of Car Ownership

Today’s car buyers face sticker prices that are pushing the limits of affordability. The average new vehicle price is approaching $42,000, meaning even standard sedans and crossovers now carry price tags once reserved for luxury models. Half-ton trucks, for example, often start around $50,000, which translates to monthly payments around $850 or more when financed over six years at current interest rates.

These figures don’t even factor in additional costs like insurance, maintenance, and fuel, which further strain budgets. As a result, many consumers are carrying payments that feel more like mortgage costs than typical vehicle expenses.

💸 The Payment Mindset: “Can I Fit It In?” vs. “Can I Afford It?”

One of the biggest issues contributing to unsustainable car payments is how affordability is perceived. Many people define affordability as simply being able to fit the monthly payment into their budget without overdrafting, rather than considering the total cost of ownership or the long-term financial impact.

"Most Americans describe affordability as I can make that payment."

This limited view is often shaped by lenders and marketing teams who approve loans based on the likelihood of monthly payments being made, not on whether those payments align with the borrower’s broader financial goals. Consequently, many buyers end up financing vehicles that consume 20% or more of their monthly income, leaving little room for savings or unexpected expenses.

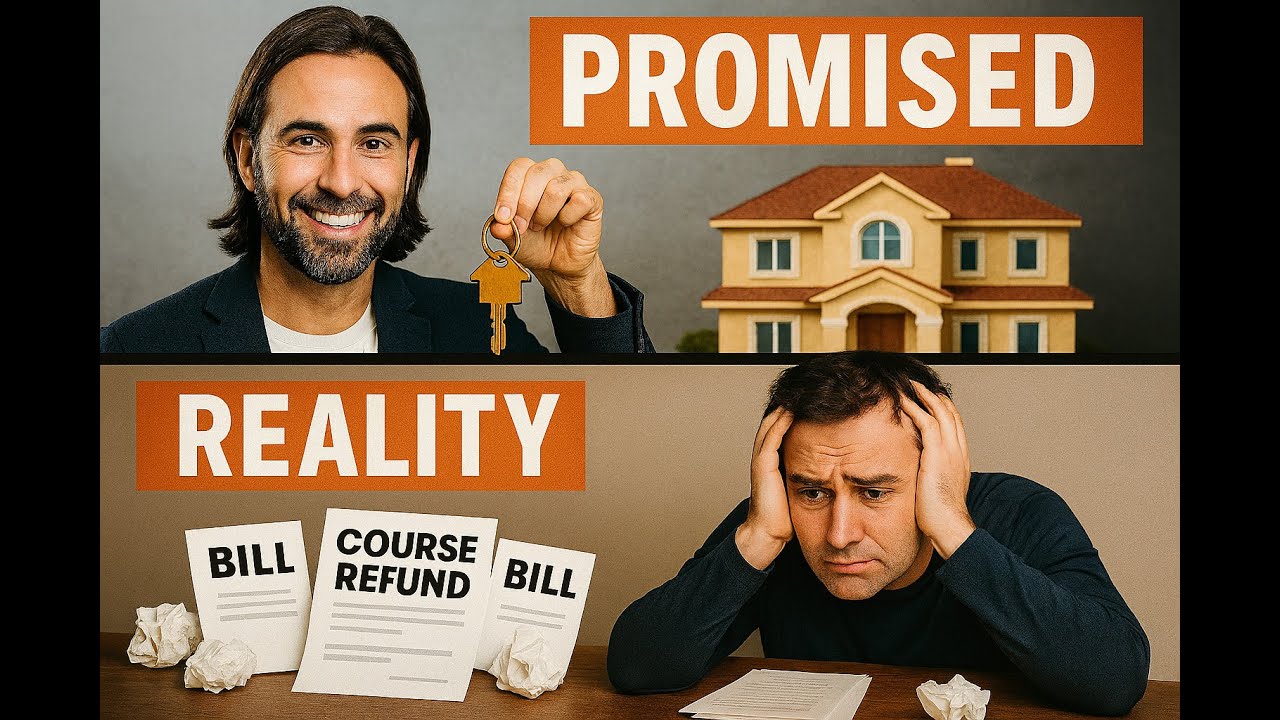

🔄 The Dangerous Cycle of Debt

High car payments often trigger a ripple effect in personal finances. When a large portion of income is tied up in vehicle payments, it reduces the buffer available for emergencies. This frequently leads to borrowing for other needs, such as vacations, home repairs, or everyday expenses, which then accumulate into a web of debt.

Over time, this cycle rewires financial decision-making. Instead of asking “Can I afford this?” the question becomes “Can I fit the payment in?” This shift traps many individuals in a paycheck-to-paycheck existence, unable to save or reset their financial health. The only perceived options become refinancing debt, trading in vehicles prematurely, or hoping no major expenses arise—often with disappointing results.

📉 Why Longer Loan Terms Aren’t the Solution

While some assume that higher monthly payments reflect aggressive payoff strategies, data shows the opposite trend. The average car loan term has stretched to about 66 months (five and a half years), with six- and seven-year loans becoming increasingly common. Instead of paying off loans faster, buyers are extending terms to lower monthly payments.

Despite longer terms, many still face payments of $800 or $900 a month, signaling that the vehicles purchased are likely far beyond their budget. This extended debt period increases the total interest paid and keeps individuals financially strained for years.

🎭 The Illusion of Lifestyle and Financial Health

Social media and societal pressures have turned cars into status symbols, pushing people to finance lifestyles they cannot truly afford. Flashy vehicles and exotic vacations are often funded through debt rather than savings, creating a facade of success.

Comparing lifestyles without understanding the underlying financial commitments is misleading and potentially harmful. Many people fail to consider interest rates, monthly debt obligations, or stress levels associated with these purchases. Real wealth and financial freedom tend to be quiet—far from the spotlight of social media.

🔑 Practical Tips to Manage Car Payments Wisely

-

Set a realistic budget: Don’t base your spending on loan approval amounts. Consider total ownership costs including insurance, maintenance, and fuel.

-

Avoid long-term loans: Longer loans can lower monthly payments but increase overall interest costs and financial strain.

-

Build an emergency fund: Having savings protects against unexpected expenses and prevents debt accumulation.

-

Focus on value over features: While modern cars come with many attractive amenities, prioritize affordability and reliability.

-

Break down the cost: For example, a $1,000 monthly car payment equates to over $30 per hour driven, often exceeding hourly wages.

📊 Key Takeaways

-

Average car payments have surged to $745 for new cars and $521 for used cars, with interest rates adding to the cost.

-

Many buyers confuse "affording the payment" with true affordability, ignoring total costs and long-term financial impact.

-

Longer loan terms are common but typically indicate overspending rather than smart payoff strategies.

-

High car payments create a debt cycle that affects overall financial stability and emergency readiness.

-

Social pressures and lifestyle comparisons often mask the reality of financial stress behind car ownership.

❓ Frequently Asked Questions

What is a sensible percentage of income to spend on car payments?

Financial experts generally recommend keeping all vehicle expenses, including payments, insurance, and maintenance, below 15% of your monthly take-home pay to maintain a healthy budget.

Are longer loan terms a good way to lower monthly payments?

While extending loan terms reduces monthly payments, it usually increases total interest paid and prolongs financial strain. Shorter loans are better for minimizing total cost if monthly payments are affordable.

How do interest rates affect car payments?

Higher interest rates significantly increase monthly payments and overall loan cost. New car loans typically have lower rates than used car loans, but rates have generally risen in recent years.

Is it better to buy a used car to save money?

Used cars often come with lower purchase prices but higher interest rates, which can increase monthly payments. Buyers should weigh total costs, including potential maintenance expenses.

How can I avoid getting trapped in a cycle of debt related to car payments?

Building an emergency fund, setting realistic budgets, avoiding unnecessary features, and choosing vehicles within your means are key strategies to prevent debt accumulation.

🔚 Final Thoughts

Car payments have become a significant financial burden for many, driven by rising vehicle prices, high interest rates, and shifting attitudes toward affordability. The common mindset of simply fitting payments into the monthly budget overlooks the broader financial consequences, often leading to long-term debt cycles and limited financial freedom.

Understanding the true cost of car ownership, resisting social pressures, and making intentional, informed decisions can help consumers avoid these pitfalls. Prioritizing manageable payments and building financial buffers are essential steps toward sustainable vehicle ownership and overall financial health.

🚀 Ready to Build Real Wealth?

You've learned the strategy – now it's time for action!

🎬 Get Weekly Financial Education

Join thousands learning smart money strategies that actually work.

📺 Subscribe to @StartWithCents

💎 Download Your Free Wealth-Building Tools

Get the exclusive "First Dollar Game Plan" – your step-by-step guide to financial freedom.

📚 Continue Your Financial Journey

Explore more money-smart articles and strategies.

📖 Read More Posts • 🏠 Homepage

💡 Remember: Knowledge without action is just entertainment. Take one step today!